I HAVE WATER DAMAGE IN MY HOME OR BUSINESS DUE TO A PIPE BREAK!! SO WHAT DO I DO NOW?!

As this article goes to print, Texas residents and business owners will have suffered hundreds of millions of dollars in property damage due to the recent Arctic outbreak that migrated to the Lone Star State. Homes and business throughout the southwest are facing consequences because water pipes are breaking. The effects of this meteorological phenomenon is clear, as is the overwhelming structural toll on both residential and commercial properties. However, what remains murky is what policyholders can do under these circumstances in order to both protect their property and advance their insurance claims in a timely and complete manner.

The attorneys and staff at ZMF have represented and continue to represent thousands of insureds across the country facing incredible odds regarding their property losses, their resulting insurance claims, and unfortunately, subsequent litigation. Our success stems from a comprehensive and evolving knowledge of not only the legal aspects of the claims process, but the entire realm of exercises that a policyholder must complete from day one.

That being said, the following questions and answers encompass some of the most common, yet pressing issues faced by our friends and neighbors presently dealing with the aftermath of Winter Storm Uri. If you have questions regarding any of the following concepts, or are simply struggling in general with the next steps to your claim, please reach out to us directly at 713.350.3529. We also welcome you to visit our website at www.ZMFLaw.com to learn more about our firm and the team who would be representing you. We are happy to assist you during this difficult time and take some of the burden from your shoulders.

How do I make a timely claim?

The vast majority of home and business owners purchase insurance coverage through a local insurance agent. For example, both State Farm and Allstate, two of the most prolific carriers in Texas, have captive agents throughout the state who sell only State Farm or Allstate policies. These are also the individuals who filed claims on behalf of their policyholders.

So how does this relate to making a claim?

Do not delay in submitting a formal claim. Contact your insurance agent directly, and they will assist you in making a proper claim for your pipe break damage. In doing so, make sure you have a copy of your policy in-hand, and can explain in detail the damage that you have seen both inside and outside of your property, the time at which you discovered it, and its effects as to all aspects of your home or business.

Alternatively, both residential and commercial policies typically include “1-800” numbers on their face, with related instructions regarding who to call and what information to provide when making a claim. As direct calls to your agent (discussed above) can be stalled by heightened degrees of phone traffic during this turbulent period, consult your policy and accompanying materials to find this critical contact information. It may be a better way to streamline the process.

What steps can I take to accurately show the damage I’ve suffered from Winter Storm Uri?

Answering this question requires an understanding of the coverage that you’ve purchased through your insurance policy. Each area or “bucket” of coverage is triggered by different types of loss, all of which require varying methods of demonstrating and quantifying that loss. The following breaks down each type of coverage, along with the best evidence of your related damages:

Structural Loss – Simply put, this is the physical loss to your home or commercial building. It is many times referred to as “Coverage A”, and in the context of a pipe break, relates to the broken elements of your plumbing system, as well as the consequential water-related damage to the area surrounding that break. This can be as simple as nearby drywall, or as tragic as an elevated break that saturates every floor of a home or business.

In order to document this loss, the key is to photograph every perspective of the damaged area, including all areas of consequential damage. In addition, if you make repairs yourself or have repairs made through a professional, you must maintain all receipts reflecting cost of materials purchased, work orders and invoices for related services, estimates of repair costs, etc. This will be critical to present to your insurance company once a claim has been opened on your behalf.

Lost contents – In the residential world, this is known as “personal property” coverage. However, commercial policies refer to such coverage as “business contents.” Typically found under “Coverage B” within your policy, this benefit extends to the belongings within your residence or commercial structure. Pipe breaks can wreak havoc on the contents of a home or business, and documenting these losses is just as important as doing so for your structural loss.

Once again, photos are key to memorializing contents damage. Make sure to not only capture the assets themselves but provide a broader perspective that includes the room (and area of the room) in which that item is located. This will negate the possibility that a later assigned insurance adjuster takes issue with whether that specific item was within the trajectory of the broken pipe.

Also, be mindful that too many people only think of photographing post-storm damage, rather than also providing pre-loss representations of these same items. Photos of family scenes within our homes, all of which necessarily include our contents in the background, are ubiquitous with today’s cell phones. Without exception, you will possess pre-storm photos of many items, reflecting their original condition, that are ultimately damaged due to Winter Storm Uri. (In the future, it is also advisable to photo your contents on a regular basis – especially in the days immediately preceding the next storm – for this same purpose.)

Alternate Living Expense (“ALE”) – Specific to homeowner’s policies, ALE is coverage you purchase for instances of displacement from your home. Depending on your specific policy, this can cover hotel stays, meals with your family, or related expenditures that would not have arisen absent an event like a fire, hurricane, or the recent cold snap. Sadly, while many people immediately think of their structural or contents loss, far too few take advantage of their ALE coverage, although it can be an essential benefit of their policy.

Documentation of ALE damage is an ongoing process. Receipts from hotels, meals, etc. should be not just maintained, but consistently submitted to your carrier. Be mindful that geographical and practical limitations may exist (such as disallowing air travel to an exotic location or week long stays at the Four Seasons), which limit you to the essentials of living outside your home. This may also be for a limited period of time. Nevertheless, all policyholders should be familiar with their policy, and ensure that they take advantage of their ALE coverage, if available.

Business Interruption (“BI”) – Solely applicable to commercial properties, and the businesses they house, BI coverage addresses the profits lost by a business due to a covered event. In the instant circumstance, pipe breaks that flood commercial properties simultaneously disrupt ongoing business activities and can stifle profits for extended periods of time. Ongoing documentation of these losses is critical to proving up a claim for business interruption losses.

From the outset, insureds must note that this coverage is not intended for every dollar a business would have received during a temporary shutdown. It only extends to cover the profits lost during that period of time, which may also be limited to a finite number of weeks or months under your policy. Therefore, it is important to supply your business data as to both receivables and expenses during the specific time of shutdown. For example, a restaurant would need to show costs of overhead and inventory, as well as income from customers. A hotel would need to show historical rent rolls demonstrating consistency of occupancy, as well as a ledger of receivables. Only with a complete picture of what profits your business would have yielded after a loss, can a proper claim for BI coverage succeed.

What duties do I have as a property owner?

A successful claim not only depends on an honest insurance company standing behind their policyholder, but also rises and falls on an insured acting appropriately, and in keeping with their policy requirements, after a loss occurs. Indeed, almost every insurance policy contains a section entitled “Duties After a Loss,” which defines the expectations and responsibilities placed upon a policyholder in bringing a proper claim. While not every policy has identical language in this regard, the following list sets forth the most conventional duties to which a policyholder must adhere, as well as the reasons that each requirement exists:

Make a Timely Claim – As set forth above, being prompt in making a claim is critical to success. In fact, Texas law requires that claims be made timely, to prevent compromising the ability of the insurance company to assign an adjuster and complete their investigation while the claimed damage is still fresh. Delay in making a claim can allow for evidence of your loss to become stale, or worse yet, to allow the possibility of another weather-related event occurring, and causing interrelated damage to the same property. (Remember the proximity in time between Hurricanes Katrina and Rita in 2005.) Always remember that because the policyholder bears the burden of proving the particular losses attributable to a specific event, overlapping damages can be quite troublesome in pursuing payment of your claim. Accordingly, you must not delay in submitting your claim to your insurance company.

Allow the Insurance Company to Inspect the Property – Almost every policy allows insurance carriers the opportunity to reasonably inspect your home. As a policyholder, it is in your best interests to not just allow, but to facilitate this inspection as soon as possible. In doing so, make sure you provide direction to all areas where you have seen damage at your property, allow access to attic spaces, and make sure not to inhibit or prevent the adjuster from completing a full inspection. Remember that this not only increases the chance for payment of your claim, but also negates any future argument that you weren’t cooperative in allowing the carrier to inspect the property and damages.

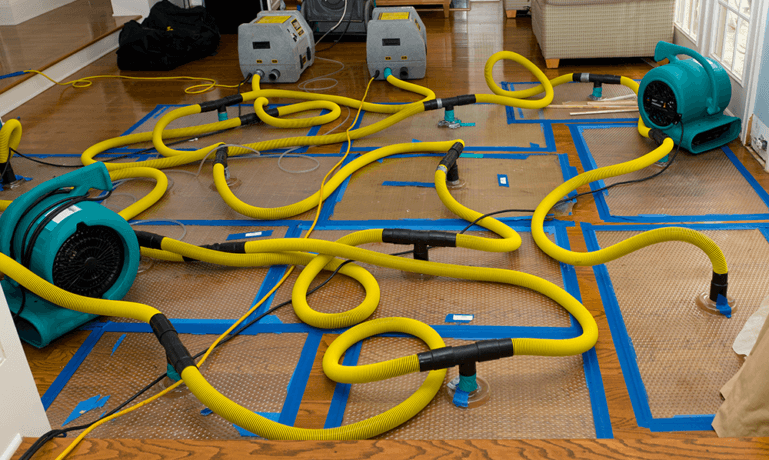

Mitigate Your Damages – Another reason to move quickly with regard to the above two duties, is the desire of every home and business owner to get repairs completed on an expedited basis. Moreover, your insurance policy almost certainly contains a Duty to Mitigate Damages section, which requires a home or business owner to take reasonable measures to protect their property. This can include “blue tarping” a roof after a hurricane or clearing a residence of debris after a fire. In any circumstance, this duty is designed to prevent additional damage from resulting should the inspection process be delayed after a catastrophic event.

Submit a Proof of Loss (“POL”) – In the context of any loss, an insurance company can demand policyholders to provide a signed and notarized Proof of Loss, setting forth the amount of damage claimed for their loss. This document is almost always supplied directly from the carrier when a claim is made. In fact, your policy will specify that the home or business owner must submit this document within a particular amount of time post-loss. Be thorough in evaluating and quantifying your loss. Relatedly, be aware this will likely require the involvement of a professional estimator on your behalf to ensure all damage is identified, memorialized, and included in your claim.

Sitting for an Examination Under Oath (“EUO”) – In addition to the above, insurance companies may also require their policyholders to sit for an EUO, which is an examination under oath. Aptly named, this process involves the insured meeting in person with their insurance carrier’s attorney, who may question them for hours regarding their loss, the underlying property, and the damages they are seeking, in addition to other related (or unrelated) areas. While many policyholders navigate this process on their own, it is advisable to retain counsel with an emphasis in first party practice, in order to protect your rights and your claim. Despite mantras such as “Like a Good Neighbor” and “You’re in Good Hands”, the insurance company is simply not your friend. Have someone present you can count on and who is truly on your side.

The professionals at ZMF know that making a claim can be daunting. The above-described requirements, considerations and moving parts can be as confusing as they are complex.

However, you need not go through this process alone. You are once again invited to call one of our first party professionals at 713.350.3529 to learn more about our team. We stand ready to assist you with your claim, guide you through the labyrinth set forth by your carrier, and represent you legally should the insurance company refuse to stand by your side. Our job is to remind you that all policyholders have a voice in this process. It’s what we do every day for every client, and we do it at the highest level.